In March, Huron Valley Guns in New Hudson, Michigan, caught the front end of a national surge in gun buying. Lines snaked through the store’s cavernous, multilevel interior, past an extravagant mural of George Washington, around a model Liberty Bell, to its entrance, where taxidermied deer heads line the walls. Owner Ed Swadish thought, briefly, that the new customers might protect him from the careening American economy, which in the coming months would swallow north of six million jobs.

But then an employee came down with a fever, and Swadish closed the shop for two weeks. When he reopened, Michigan Governor Gretchen Whitmer issued an order closing all nonessential businesses, including gun stores. Swadish ignored the order, though he closed the shooting range, restaurant, and barbershop that he operates inside his store. By the end of April, he found that the increased gun sales were hardly a lifeline; he was $40,000 in the red.

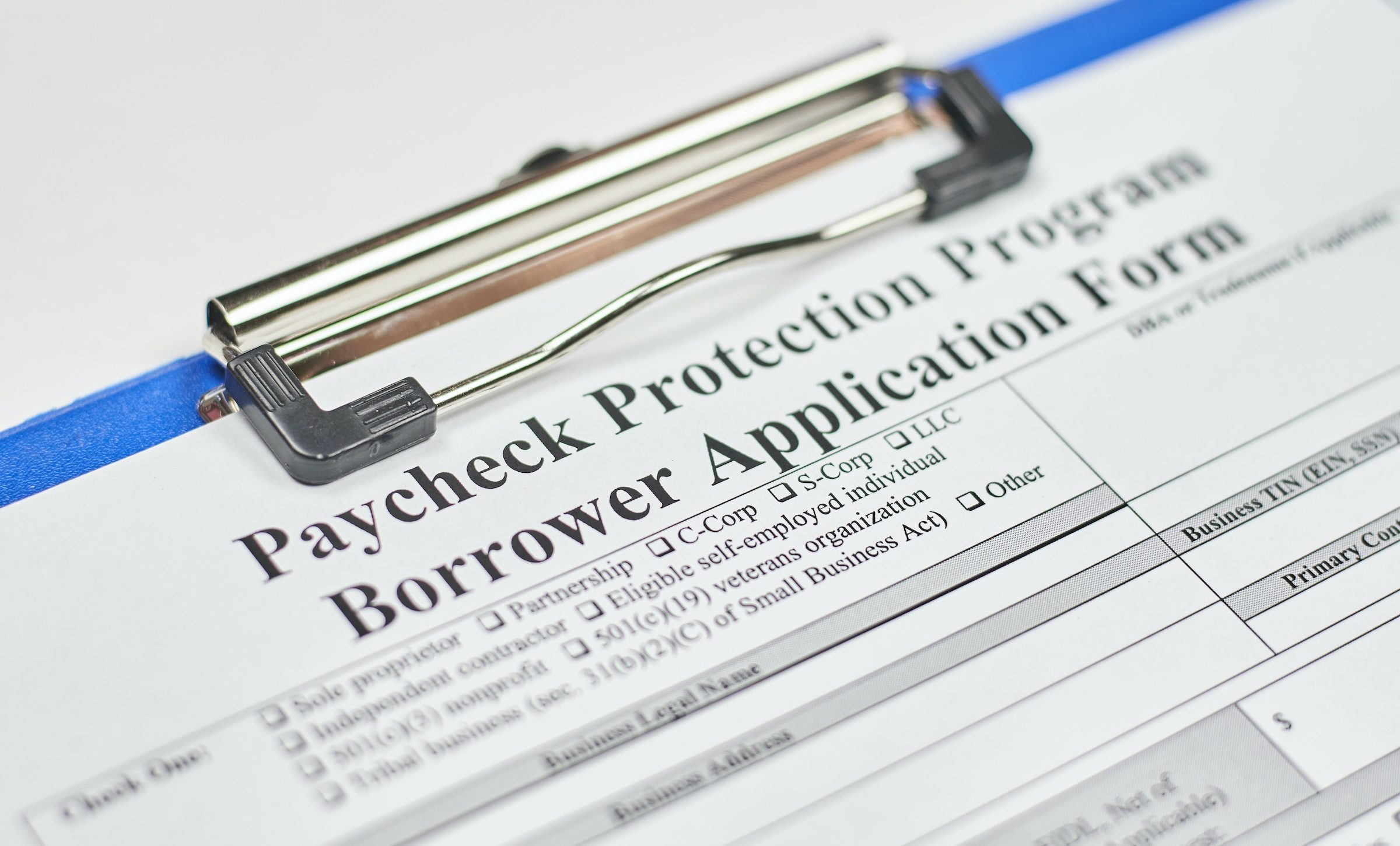

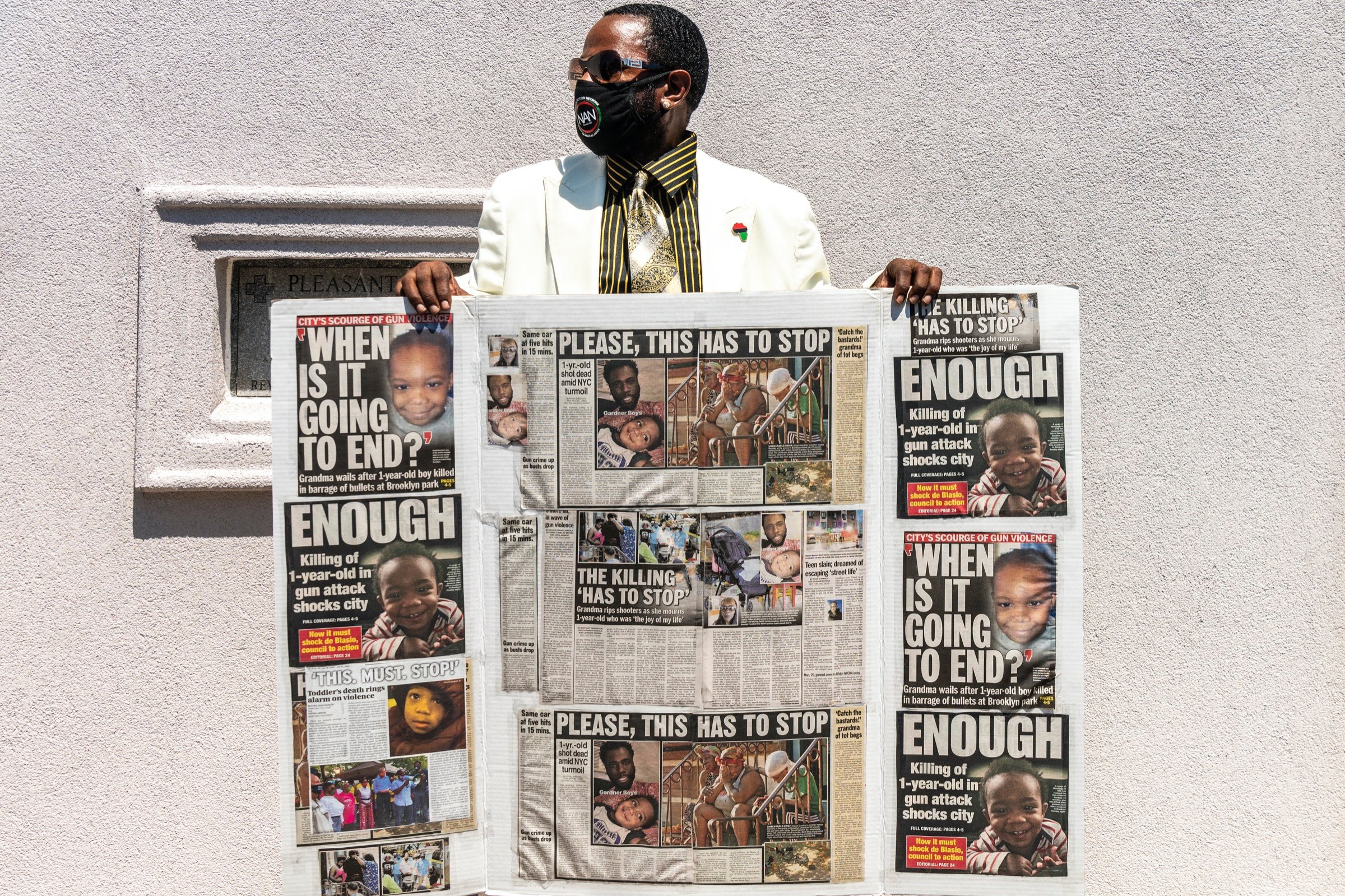

To stay afloat, Swadish joined hundreds of gun retailers across the country and applied for a loan through the Paycheck Protection Program. The program was established to arrest climbing unemployment figures, and inject businesses with funds to pay employees while profits suffered from the pandemic. It helped sustain Huron Valley Guns until Michigan began a gradual reopening in June. But despite the return of an all-time high demand for firearms that month — driven by protests against police brutality after the killing of George Floyd — Swadish still had difficulty turning a profit. The new surge had quickly cleaned out his inventory, and caught many firearms manufacturers and distributors flatfooted, unable to fulfill orders. What might have spurred a roaring recovery instead caused supply shortages that have left the industry struggling to capitalize on the historic demand for its products.

“Now the problem is: You can’t get the stuff the people want to buy,” Swadish told The Trace. “So it still hurts.”

The gun industry has fared better than most since the pandemic began. When the stock market tumbled in mid-March, gun company stocks soared. When retail businesses closed to prevent the spread of the virus, gun stores by and large remained open, many in defiance of state orders. But the splashy headlines announcing this exceptional performance have belied the reality faced by many retailers across the country, who have had difficulty keeping up with demand, and whose profits often depend on more than gun sales alone. “Everyone thinks it’s great to have a thing like this for gun sales,” said Tony Clements, who runs Trop Gun Shop in Elizabethtown, Pennsylvania. But, he added, “If you sell 50 guns but only can bring 25 in, it’s gonna catch up to you.”

Most retailers interviewed for this story said that, since May, new inventory has trickled in, preventing them from capitalizing on the biggest boon the industry has ever seen. Clements said he’s run out of the 9mm ammunition used in many handguns, as well as the 5.56 rounds typically used in AR-15s. One of his store’s most profitable offerings, an indoor shooting range, has languished in the resulting drought, without any ammunition to provide the hoards of eager first-time shooters. “If we sell a gun to somebody and don’t have ammo, it doesn’t do them any good,” he said. Clements added that Glock and Sig Sauer, two of the country’s largest gunmakers, have struggled to fulfill orders during the surge, leaving him short on his best-selling handguns. (Neither Sig Sauer nor Glock responded to requests for comment.)

National and regional firearm wholesalers confirmed that inventory is in short supply. Bryan Tucker, the CEO of Davidson’s, one of the nation’s largest gun distributors, said that his company had been “hand to mouth” since March, immediately shipping out whatever products they receive. He characterized the current demand for firearms as the most intense he’s seen in his nearly four decades in the industry, a sentiment smaller regional wholesalers echoed. Jim Bartol, president of the Pennsylvania-based regional wholesaler, Accuflite, told The Trace he hasn’t “seen anything like this,” in his 43-year career — “nothing even remotely close.” He said that he has yet to receive orders his company placed with manufacturers in March, and said Accuflite has sold out of several calibers of home defense ammunition, several brands of handguns (including Glock and Taurus), and all of his short-barreled shotguns.

In Moline, Illinois, Chris Smith, who runs the firearms wholesaler Shooting Sports Unlimited, said his July sales are below where they were in 2019, despite the continued demand nationally. He said he’s turning down nearly 20 interested buyers per day because he’s unable to place orders for most guns. “I could be selling a ton right now if I was just able to get the guns,” he said. “We usually fulfill 15 orders a day on average, but right now it’s closer to two or three.”

The shortage has yielded mixed results for dealers across the country. Many, like Swadish and Clements, have turned inconsistent profits with their inventories depleted, unable to sell enough guns to compensate for decreased supply of their stores’ more profitable products. Profit margins on guns are slim, Swadish said — between 10 and 12 percent, compared to roughly 30 percent for accessories and other retail goods. “Even though gun sales are much higher again,” he explained, “the stuff we make money off of” — ammunition and accessories — “hasn’t been readily available.”

Many of these businesses turned to PPP loans for sustenance. The Trace identified more than 200 licensed firearms retailers that received money through the loan program, with disbursements totaling between $57 and $137 million altogether. The companies — a majority of which are hardware and sporting goods stores, not stand-alone gun stores — reported retaining nearly 10,000 jobs as a result of the funds.

Retailers who exclusively sell firearms have had better luck weathering the inventory turbulence. David Rich, who owns Naples Gun Shop & School in Naples, Florida, said his sales are four times what they were this time last year. Business is so strong that when coronavirus cases first ballooned in Florida in March, threatening closure, he didn’t even consider filing for the PPP loan. Since March, he said, his store has completely sold out its inventory multiple times.

When asked about widespread inventory shortages, Rich said he wasn’t particularly worried. He expects that the slew of first-time gun buyers will expand his customer base, and that an eventual slowdown in demand will give manufacturers breathing room to catch up on backorders. But, he added, “I am concerned more generally with how physical retail locations such as mine will compete [in the future] with shops that are mainly online.” Rich said it’s possible that if demand takes too long to stabilize, larger, online stores might swallow up increasingly scarce inventory, starving mom-and-pop locations like his.

Rich’s comments were echoed by other store owners contacted by The Trace. Wild swings of fortune — huge sales boosts, temporary closures, and inventory shortages — have ginned up a pervasive unease among gun store owners that has only sharpened as states roll back reopening plans in response to the accelerating spread of COVID-19. This precarity has made even successful store owners like Rich distrust their steady sales figures, and affirmed some retailers’ reliance on the PPP loans.

Jeffrey Koenen, who runs Reineman’s True Value in Burlington, Wisconsin, said his store had escaped the hardest weeks of the pandemic relatively unscathed, but that he had filed for the PPP loan as a precautionary measure. The surge in gun sales kept his profits steady, balancing out a depression in sales of other hardware supplies. Whereas sporting goods sales typically accounted for 13 percent of his store’s profits, in the first six months of 2020 they accounted for 28 percent. He is skeptical that this formula is a stable one, especially as inventory of firearms has thinned. But his PPP loan gave him a “security blanket,” he said, “knowing that the money was there if we absolutely needed it.”

Data analysis by Daniel Nass.